Amazon shares dropped in after-hours trading after the company reported strong fourth-quarter revenue but fell slightly short of profit expectations while unveiling plans for a major increase in capital investment.

The company announced it expects to spend about $200 billion in 2026 to expand infrastructure supporting artificial intelligence, cloud computing, robotics, semiconductor development, and satellite technology. Amazon CEO Andy Jassy said the investment is driven by rising demand, particularly within Amazon Web Services, which continues to see rapid growth from businesses seeking AI-powered computing capacity.

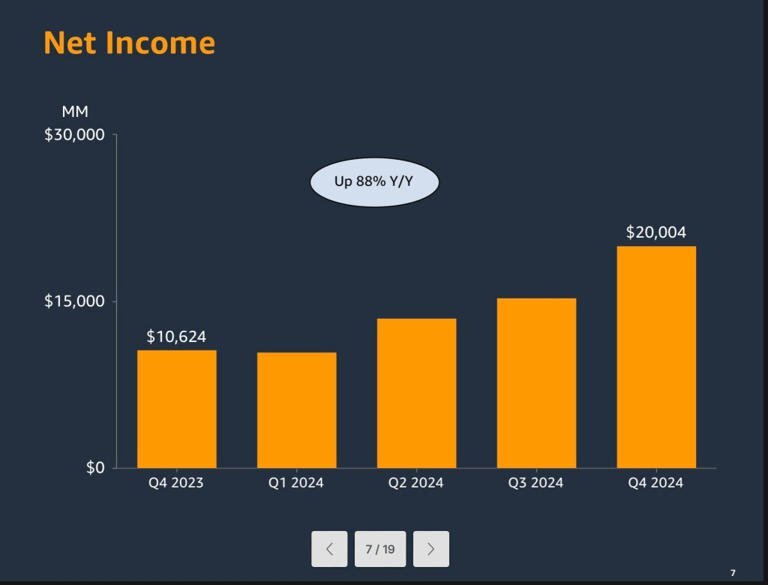

Amazon reported quarterly revenue of $213.4 billion, marking a 14 percent increase year over year and the first time the company has surpassed $200 billion in quarterly sales. Earnings per share reached $1.95, slightly missing analyst expectations but still improving from the previous year. Net income rose to $21.2 billion.

Amazon Web Services generated $35.6 billion in revenue during the quarter, representing 24 percent annual growth and its fastest expansion in three years. The company said AWS demand remains strong and could accelerate further if additional data center capacity were available.

Other business segments also recorded gains. Online retail sales rose 10 percent to $83 billion, while advertising revenue climbed 23 percent to $21.3 billion. Subscription services, including Amazon Prime, generated $13.1 billion, reflecting continued growth in membership and digital services.

Amazon projects first-quarter revenue between $173.5 billion and $178.5 billion. Despite investor concerns about profit margins and spending levels, company leaders maintain the aggressive investment strategy is aimed at strengthening Amazon’s long-term position in emerging technology markets.