Seattle’s startup lawyers and bankers have long assisted founders in raising capital. Now they are pooling their own resources to invest in promising early-stage technology companies across the Pacific Northwest.

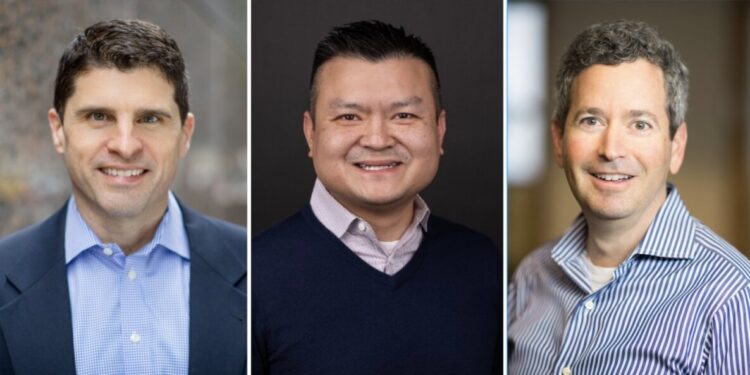

A trio of longtime Seattle startup service providers, Minh Le of Stifel Bank and Craig Sherman and David Wickwire of Wilson Sonsini, are collaborating to lead the Pacific Northwest fund for Service Provider Capital, a national firm that invests on a regional basis.

SPC launched in 2014 from Colorado with a distinctive startup investing model. It co-invests in early-stage rounds led by institutional venture firms, typically contributing smaller amounts into those same deals.

The investors, limited partners or LPs, come from law, banking, accounting, and insurance communities, reflecting an effort to allow the professionals who support startups to also invest in them. Angel investors and serial entrepreneurs also participate, using SPC as a vehicle to back more local founders.

“It’s folks that support the ecosystem but oftentimes don’t have access to the asset class,” Le stated.

The model aims to “index” a region’s early-stage activity, backing dozens of companies rather than concentrating on a few. SPC has expanded its model from Boulder into other regions such as New England, Texas, and Chicago. It has raised 11 funds across six regions, investing in approximately 60 companies per fund.

SPC began exploring a Pacific Northwest fund about a year and a half ago. Jody Shepherd, co-founder of SPC, described the region as a “perfect fit” given its strong venture community and deep talent pool around technology giants such as Amazon and Microsoft.

“Once we found a team like Minh, David, and Craig to lead the fund, plus an outstanding crew of well-connected LPs, an SPC Pacific Northwest fund was a no-brainer,” he stated.

Le, Sherman, and Wickwire are established figures in the Seattle technology ecosystem. Le, a former Silicon Valley Bank leader, joined Stifel Bank in 2023. Sherman and Wickwire have a combined four decades of experience at Wilson Sonsini, representing many of the region’s top venture-backed startups.

Unlike traditional funds, the local managing directors maintain their day jobs. They help identify deals through their networks, whilst Service Provider Capital makes final investment decisions.

The objective is not to generate new business for their firms, they explained, but to strengthen the broader ecosystem by expanding access to early capital. The fund’s LP base includes many of their professional peers and competitors, from other law firms and banks across the region.

The fund’s model is intentionally broad and formulaic. Due diligence is minimal; meeting the criteria, an early-stage technology or life sciences startup in the Pacific Northwest raising its first round from an institutional investor, is often sufficient.

Because the fund relies on trusted institutional leads, founders do not need to pitch SPC directly. If they meet the criteria, the fund can join a round quickly.

The new Pacific Northwest fund has raised $3 million and has already made two undisclosed investments. It writes checks in the $50,000 to $100,000 range.

The fund also aims to fill a gap left by longtime angels who have retired or joined venture firms, serving as a kind of “strategic angel” to help complete early rounds, Wickwire stated.

The Seattle startup ecosystem has long been criticised for lacking local capital to invest in emerging companies. The closure of Techstars Seattle last year created another gap in early-stage funding and mentorship.

“There are great entrepreneurs here, there are great engineers here, and the more capital there is supporting the local market, the better off we’ll all be,” Sherman said.

The fund’s structure addresses a persistent frustration within startup ecosystems: the professionals who witness entrepreneurial success daily often lack mechanisms to participate financially in that success beyond their professional fees. Lawyers draft term sheets, bankers provide credit facilities, accountants audit financials, yet their compensation comes exclusively from services rather than equity upside.

Service Provider Capital’s model creates a structured pathway for these ecosystem participants to become investors without abandoning their primary professions or facing conflicts of interest that direct investments might create. By pooling resources and delegating final investment decisions to SPC, individual service providers avoid situations where their financial interests in portfolio companies could complicate their professional obligations.

The $50,000 to $100,000 check size positions SPC as a complementary rather than lead investor. Early-stage rounds in the Pacific Northwest typically range from $1 million to $5 million for seed and Series A stages, meaning SPC contributions represent 1% to 10% of round totals. This sizing allows the fund to participate in numerous deals without requiring massive capital commitments from LPs.

The minimal due diligence approach reflects confidence in institutional lead investors’ judgment. When reputable venture firms conduct extensive evaluation before committing larger sums, SPC leverages that analysis rather than duplicating efforts. This efficiency allows rapid decision-making that can help founders close rounds faster.

The formulaic criteria, requiring institutional lead investors, creates a quality filter whilst maintaining broad accessibility. Not every promising startup will attract institutional attention, but those that do have already cleared significant evaluation hurdles that reduce investment risk.